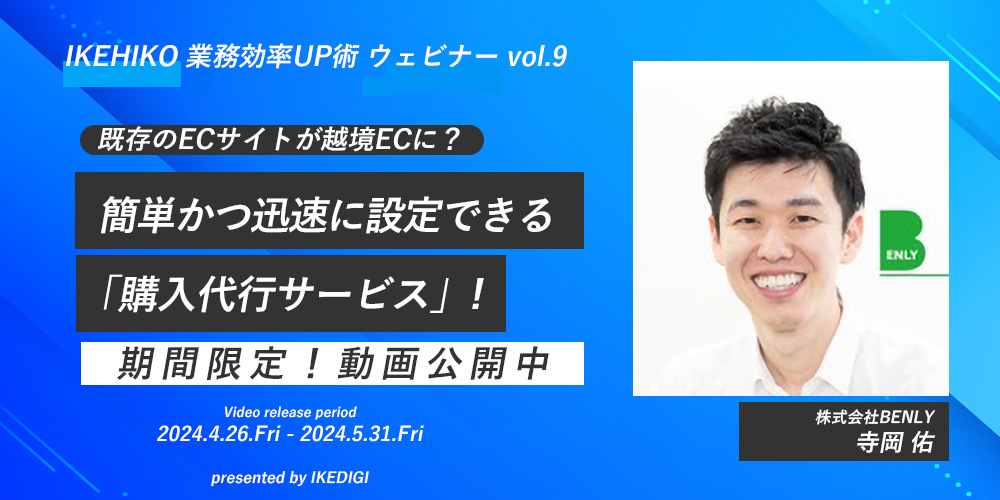

企業様紹介

株式会社BENLY様

株式会社BENLY様は越境EC事業に携わり越境EC支援サービス、海外物流支援、ECサイト制作、海外マーケティング支援などを行っております。

▼ご紹介動画はこちら

▼公式サイトはこちら

https://benly.co.jp/

こんな方におすすめ

・ノーリスク、ノーコストで越境ECを始めたい方

・越境ECを始めたいが何から手をつけていいか分からない方

こういったお悩みをお持ちの方ははお気軽にご相談ください!

また、越境EC向けの商材をお探しの方は下記のリンクからおすすめ商材を確認できます!

越境EC向けの商材はこちら

お問い合わせ・相談

一度ご相談をご希望の方は、下記のリンクのお問い合わせ先へご相談ください。

レビュー

6958

Hello! I could have sworn I've been to this blog before

but after browsing through some of the post

I realized it's new to me. Nonetheless, I'm definitely glad I found it and I'll be bookmarking and checking back often!

My webpage Reyes Restoration

続きを読む 閉じる

My partner and I stumbled over here from a different page and thought I might check things out.

I like what I see so now i'm following you.

Look forward to looking over your web page again.

Here is my blog post russianmarket login

続きを読む 閉じる

If some one wants to be updated with hottest technologies after that

he must be pay a quick visit this web site and be up to date daily.

Also visit my website Cleanest Body

続きを読む 閉じる

Do you mind if I quote a few of your posts as long as

I provide credit and sources back to your website? My website is

in the exact same area of interest as yours and my visitors would genuinely benefit from some

of the information you present here. Please let me know if this alright with you.

Thanks!

my blog post :: bola

続きを読む 閉じる

Hi! I know this is kind of off topic but I was wondering

if you knew where I could locate a captcha plugin for

my comment form? I'm using the same blog platform as yours and I'm having trouble finding one?

Thanks a lot!

Here is my blog post; Arialief reviews

続きを読む 閉じる